Why Choose Us?

Expertise You Can Trust:

Backed by proprietary technology and a team of seasoned SEC-registered investment advisors with over 25 years of industry experience and 15 years dedicated to clubs, corporations, and associations.

Fiduciary Investment Services:

Each club, corporation, and association is assigned a fiduciary-licensed investment advisor, ensuring your assets are managed with care and integrity.

Preferred Custodian:

Assets are securely custodied with our preferred provider - Charles Schwab Institutional, providing industry-leading safety, reliability, and peace of mind.

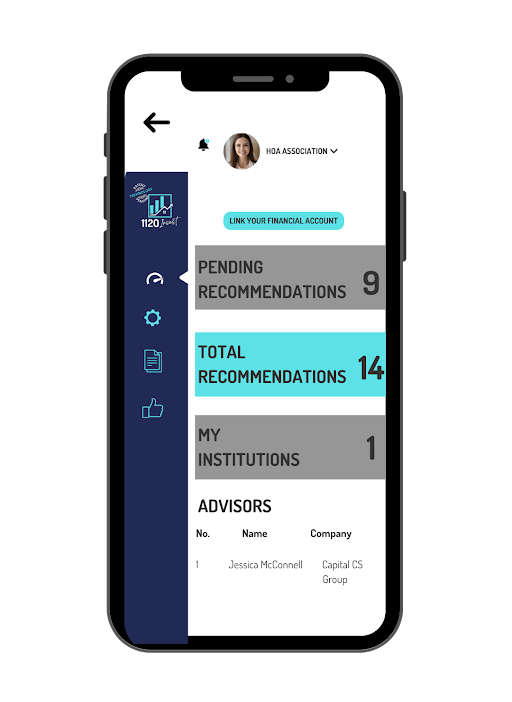

Innovative Technology:

1120 Invest Technology is a patent-pending solution designed to streamline processes, redefine how organizations handle investments, and enable informed decision-making.

15+

PROVEN CLUB & CORPORATE EXPERTISE

20+

TRUSTED GUIDANCE

1000+

SUCCESSFUL STRATEGIES

What we do?

Simplified Investment Management for Clubs, Corporations, and Associations

Compliance-Driven Investment Policies

- Designed to help meet unique state requirements.

- Provides controls, workflows, and documentation templates to help ensure compliance with your organization's investment policy.

- Collaborates with your club, corporation, or association to develop and implement an investment policy that aligns with regulatory guidelines.

Customized Investment Strategies

- Tailored strategies aligned with your goals, risk tolerance, and time horizon.

- Experienced advisors develop personalized solutions to meet your financial objectives while helping to ensure compliance requirements are met.

Efficient Investment Monitoring

- Provides daily tracking of investment holdings and maturing assets.

- Sends investment recommendations to managers and boards 90 days prior to maturity to ensure timely instructions, avoiding idle cash.

- Alerts for potential violations allow proactive decision-making based on accurate data.

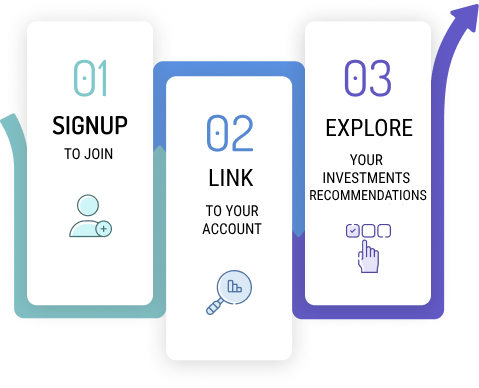

Start Your Journey with 1120 Invest Today!

To get started with 1120 Invest, simply click "Sign Up" and enter your organization's details. An experienced investment advisor from 1120 Invest will reach out to guide you on your investment journey.

F.A.Q

Clubs and corporations should adopt a prudent investment strategy focused on three key priorities, ranked in order of importance:

- Safety: The preservation of reserve funds is critical. Investments should minimize risks, with U.S. Treasuries and FDIC-insured accounts being among the safest options. Risk levels vary, with stocks and non-government bonds posing the highest risk, while bank savings accounts and government-backed securities offer lower risk.

- Liquidity: Clubs and corporations should ensure their investments can be quickly converted into cash to cover emergencies or unforeseen expenses.

- Yield: Pursue competitive returns without compromising the safety of the principal. Customized investment policy statements can include strategies to combat inflation by incorporating low-cost exchange-traded funds (ETFs) that align with capital preservation and reduced volatility goals. This allows organizations to keep pace with inflation while adhering to their financial objectives and risk tolerance.

A tailored investment strategy balancing these priorities ensures financial stability while remaining compliant with governing policies.

Clubs and corporations managing substantial reserve deposits face significant risks without a professional investment adviser. These include:

- Compliance Issues: Without expert guidance, clubs and corporations may inadvertently violate restrictions in their governing documents or fail to meet fiduciary responsibilities.

- Missed Inflation Protection: Investments that don't account for inflation may lose purchasing power over time. An adviser can recommend options like ETFs to offset inflation risks while preserving capital.

- Conflict of Interest: Allowing board members or executives to manage funds can lead to conflicts of interest, especially if they stand to benefit financially. Professional advisers eliminate this risk by offering independent oversight.

- Mismanagement: Without clear investment policies, organizations risk poor decision-making, which can result in unnecessary losses.

Partnering with an independent adviser helps clubs and corporations align their investments with best practices, avoid pitfalls, and prioritize financial stability while incorporating inflation protection strategies.